Retailer of Worth

The idea of a “retailer of worth” refers to items which can be able to retaining or growing their price over time slightly than declining in worth. This time period is used to explain a mechanism that permits people to protect their wealth with out experiencing any loss in worth over time.

It is among the three capabilities of cash that Bitcoin Journal is exploring; the opposite two are medium of trade and unit of account.

What’s a Retailer of Worth

A retailer of worth is an asset, a foreign money or a commodity that may be trusted to carry its worth over time; ideally, it doesn’t bear a lot danger. Historically, people who find themselves much less tolerant to danger will put money into a retailer of worth with an everlasting lifespan, a secure demand and low volatility.

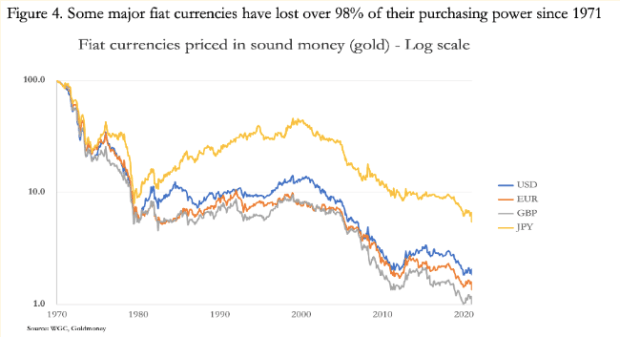

Fiat currencies are weak shops of worth since they depreciate over time on account of inflation. Commodities like bitcoin, gold and a set of different financial metals have good store-of-value attributes as a result of they’re comparatively restricted in provide and don’t deteriorate over time, thereby sustaining their worth.

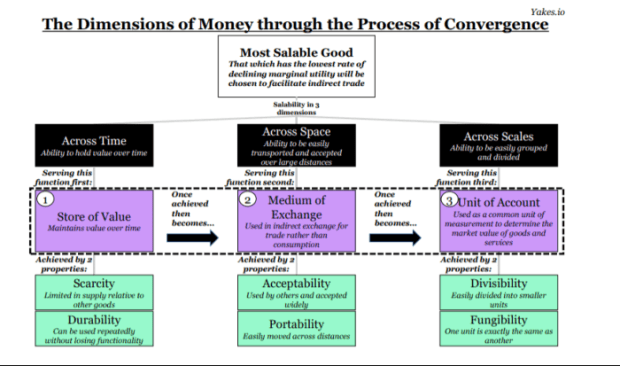

Salability is the vital property that permits one thing to be freely used as cash and defines a bodily good or asset that may be shortly bought. To have salability, cash should be divisible (scale dimension), transportable (area dimension) and sturdy (time dimension). When an asset possesses salability throughout time, we have now retailer of worth as a result of it may be trusted to keep up its worth into the long run.

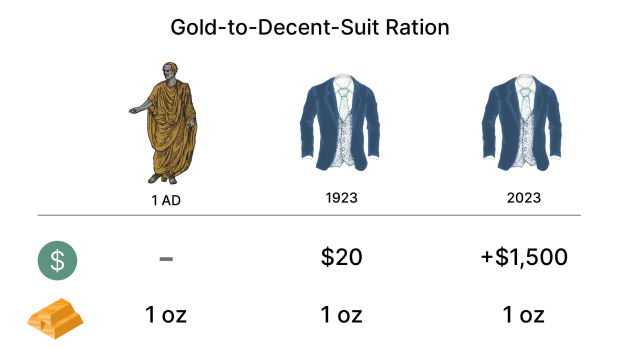

One benchmark usually used to grasp the store-of-value operate is that the worth of an oz of gold occurred to match the value of a high-quality males’s swimsuit. This precept is called the “gold-to-decent-suit ratio,” and its roots may be traced again to Historical Rome, the place the price of a top-of-the-line toga was stated to be equal to an oz of gold. After 2,000 years, the value — outlined in gold — of a high-quality swimsuit remains to be near the value of an equal Historical Roman toga.

One other instance is the value of 1 barrel of oil in fiat versus gold. In 1913, one barrel of oil price $0.97, whereas right this moment it’s about $80. In distinction, one ounce of gold would purchase 22 barrels of oil in 1913, whereas it buys roughly 24 right this moment — displaying barely any distinction within the gold worth (good retailer of worth) versus an enormous depreciation of the fiat foreign money (dangerous retailer of worth).

Why do we’d like a retailer of worth?

Cash is a vital software for buying and selling items and providers, however additionally it is necessary to have retailer of worth to avoid wasting and safe a greater future for ourselves and our households. Whereas fiat currencies are appropriate as a medium of trade, they aren’t dependable shops of worth, as they lose worth over time on account of inflation, traditionally round 2-3% per yr.

In excessive circumstances, equivalent to in Venezuela, South Sudan and Zimbabwe, hyperinflation has led to astronomical charges of inflation, making these fiat currencies very poor shops of worth. Whereas these examples function outliers, rising inflation ranges have gotten extra widespread in fashionable occasions, resulting in a pure mechanism to avoid wasting for the long run and to seek out methods to beat 2-3% inflation charges.

It’s necessary to have a dependable retailer of worth to safe the worth of our hard-earned cash over time. As poor shops of worth, fiat currencies are thought to discourage folks from saving and even incomes cash within the first place.

Is cash retailer of worth?

Within the fashionable age, we use “fiat” currencies,, the time period derived from the Latin phrase “fiat” that means a decree or an arbitrary order; it’s mainly a promise of what a price may very well be. Such an idea was established when governments’ paper or minted cash may very well be redeemed for a set quantity of a bodily commodity. Since then, the time period fiat has remained, despite the fact that currencies aren’t backed by commodities or possess any intrinsic worth of their very own.

Whereas fiat foreign money has many properties that determine it as cash, it’s a poor retailer of worth because it isn’t linked to bodily reserves, equivalent to gold or silver. The result’s that fiat currencies step by step lose worth on account of inflation or all of the sudden within the occasion of hyperinflation.

Fiat currencies are thought of tender cash as a result of they’re too depending on a authorities’s worth stability targets — usually centered on worth stability, with basic costs growing at 2% per yr — as a substitute of permitting the market to naturally resolve costs. This strategy leads governments to step by step siphon off the worth of the cash whereas growing the value of all the pieces else within the course of.

Important Parts of a Retailer of Worth

Throughout its evolution as cash, an merchandise will develop via three totally different phases, beginning with a retailer of worth earlier than changing into a medium of trade and finally a unit of account. The three dimensions of probably the most salable items are throughout time, area and thru scales.

A retailer of worth is probably the most salable good, one which has the power to protect its worth over time.

To own the operate of a retailer of worth, a salable good must be scarce; it should have a restricted provide in comparison with different items. It must also be sturdy in order that it may be used repeatedly with out dropping its performance.

- Shortage: that’s restricted in provide relative to different items and to the demand for it. Laptop scientist Nick Szabo outlined shortage as “unforgeable costliness,” that means the price of creating one thing can’t be faked. If cash is simply too plentiful, it loses worth over time as extra models can and can be created, and extra can be required to buy or service.

- Sturdiness: this property refers back to the capacity of to keep up its bodily and purposeful properties over time. Which means the foreign money ought to have the ability to face up to put on and tear and stay in circulation for a protracted interval with out deteriorating or dropping its worth.

- Immutability: Immutability is a fascinating and new property of cash as a result of it ensures that after a transaction is confirmed and recorded, it can’t be altered or reversed.

What’s retailer of worth?

Many alternative belongings can function a retailer of worth, however defining the most effective is consistently debated amongst buyers and largely is dependent upon market dynamics and buyers’ preferences. It’s price noting that sure belongings might lose their store-of-value standing over time. A main instance of that is silver, which skilled a lower in its store-of-value performance as its provide elevated on account of its rising use in industrial functions slightly than its conventional use as a financial steel.

Bitcoin

Initially considered a speculative asset on account of its notable worth fluctuations, bitcoin more and more grew to become a retailer of worth as buyers and extra folks realized its potential price as a brand new financial asset. Bitcoin represents the invention of digital, sound cash and is a scientific revolution that’s proving to this point to not solely be a retailer of worth but in addition a method to extend worth.

Bitcoin is changing into a big power within the economic system as a result of it meets the necessities of a retailer of worth higher than every other type of cash.

- Shortage: Bitcoin has a finite provide of 21 million cash, which makes it proof against the arbitrary inflation that ails conventional currencies. This restricted provide offers it a shortage worth, making it a precious asset to carry and retailer wealth.

- Sturdiness: Bitcoin is a purely data-based, immutable type of cash. Its digital ledger system makes use of proof of labor and financial incentives to withstand any makes an attempt to change it, making certain that it stays a dependable retailer of worth over time.

- Immutability: as soon as a transaction is confirmed and recorded on the blockchain, it can’t be altered or reversed. This immutability is a vital function of Bitcoin as a result of it ensures that the integrity of the ledger is maintained, and transactions can’t be tampered with or falsified. That is particularly necessary in an more and more digital world, the place belief and safety are paramount issues.

Valuable Metals

Valuable metals like gold, palladium and platinum have lengthy been good shops of worth on account of their perpetual shelf life and industrial use circumstances. They’re comparatively restricted in provide which makes their worth admire relative to fiat cash. Bitcoin is much more restricted in provide than gold and treasured metals and has appreciated in worth towards gold since its inception.

Bodily storing massive portions of gold is pricey and difficult. For that reason, buyers usually select to put money into digital gold or gold shares, that are topic to counterparty dangers. Gems like diamonds and sapphires are helpful too as they’re simpler to retailer and transport.

Actual Property

Actual property is among the most typical shops of worth on account of its tangibility and utility. Over time, its worth tends to extend, at the least this has been the case for the reason that Nineteen Seventies. Earlier than then, actual property and land saved tempo with costs, having actual returns round ~0% over longer intervals (topic to wars and crashes, and many others). Regardless of momentary downfalls alongside the best way, it stays secure, providing bodily land or building house owners a way of security when investing in it.

Actual property may be any bodily property like land or a house that can be utilized as a major residence, a trip dwelling, or a industrial property to lease or promote. The draw back of actual property is that it’s not liquid or censorship resistant. This lack of liquidity may be problematic for property house owners who require entry to money shortly and may be topic to authorities intervention or authorized motion.

Inventory Market

Shopping for shares on the NYSE, the LSE and the JPX markets has proved to be funding over time as a result of they’ve elevated their price through the years: Shares have been respectable shops of worth. Nonetheless, they might expertise excessive volatility and rely extremely on market forces and financial actions, which makes them just like fiat currencies.

Index Funds/ETFs

Index funds and exchange-traded funds (ETFs) are one other technique to get publicity to the inventory and fairness markets and supply a simple approach for buyers to diversify their portfolios.

Over a very long time, such markets have additionally proved to extend in worth, making them good shops of worth. ETFs are additionally extra cost- and tax-efficient than related mutual funds.

Different shops of worth

Individuals can get inventive with their favourite shops of worth that generally match their passions or pursuits. For instance, superb wines, basic automobiles, watches or artwork may be good shops of worth as their price usually appreciates over time.

What’s a foul retailer of worth

Perishable objects

Perishable objects are items that expire and lose worth over time, step by step changing into nugatory.

Meals makes for a poor retailer of worth, because it has an expiry date. A ticket to a live performance or for transport turns into nugatory after the expiry date, and are additionally thought of perishable.

Due to this fact, they aren’t thought of retailer of worth.

Fiat cash

We talked about that fiat currencies don’t retain their worth over time, because the chart beneath exhibits.

It’s primarily on account of inflation that they lose worth as a result of yearly, the value of products and providers tends to rise in comparison with the greenback and different fiat currencies. In consequence, currencies persistently lose buying energy.

Cryptocurrency

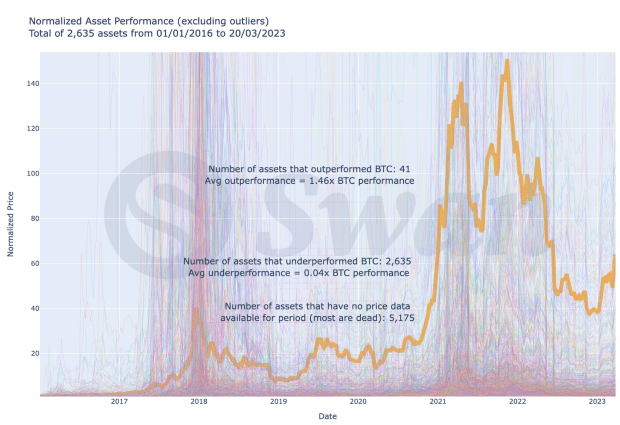

Cryptocurrency alternate options to bitcoin are similar to speculative shares, with even larger dangers since most have brief lifespans and virtually all lose worth versus bitcoin over the long run.

Cryptocurrencies with longer lifespans prioritize performance over safety, shortage and censorship resistance, making them poor shops of worth, contemplating their poor financial propositions and weak use circumstances.

In response to analysis performed by Swan Bitcoin, altcoins have confirmed to be a foul funding. The research analyzed 8,000 cryptocurrencies since 2016 and located that 2,635 of them had underperformed versus Bitcoin and a staggering 5,175 of the cryptocurrencies now not exist.

Speculative Shares

Speculative shares are small-cap belongings, additionally known as penny shares, that commerce at lower than $5 per share. They don’t seem to be thought of good shops of worth as a result of they’re extremely speculative.

Because of their excessive volatility and low market caps, they’ll shortly and all of the sudden enhance lots or lose all of their worth. They’re thought of dangerous investments and definitely don’t make good shops of worth.

Authorities bonds?

For a very long time, authorities bonds like U.S. treasuries had been thought of nice shops of worth just because governments backed them. Nonetheless, adverse rates of interest utilized for years have extremely affected the economies of huge international locations like Japan, Germany and different European international locations, making authorities bonds unattractive for the common investor. Some bonds are supposed to shield beneficiaries from inflation equivalent to I-bonds and TIPS. Nonetheless, they’re nonetheless government-led and depend on the Bureau of Labor Statistics to precisely calculate the inflation fee (which it might select, or be influenced, to not do).

The underside line

To sum up, a retailer of worth tends to keep up or enhance its buying energy over time, relying on the regulation of provide and demand, which may also be used to find out whether or not or not one thing is likely to be retailer of worth.

Many nonetheless regard bitcoin as an experiment. Nonetheless, its comparatively brief life has proved that it gives all these properties typical of cash and is an effective retailer of worth. The following problem can be to show that it may also be a unit of account.

from Bitcoin – My Blog https://ift.tt/BCHFrwJ

via IFTTT

No comments:

Post a Comment