That is an opinion editorial by Steven Hay, a author, former dealer and artwork seller.

The Ordinals controversy continues to be simmering and appears set to flare up once more quickly. Though Ordinals’ block house utilization had been trending down since March 23, 2023, the discharge of notable collections and a burgeoning mania for BRC-20 tokens appears to have reversed that development.

Ought to competitors for block house between Ordinals, BRC-20 tokens and purely financial transactions stay excessive, so will charges. And, ought to charges climb sufficiently excessive, the ghastly shades of the blocksize conflict could rise as soon as extra to torment all Bit-kind.

The Case Towards Ordinals

Charges aren’t the one flashpoint. Whereas Bitcoin has definitely had its share of detrimental headlines over time, the protocol itself has up to now escaped the identical stage of recrimination. Alternate failures, drug gross sales, numerous scams — these are all issues individuals did with the tech, quite than any intrinsic fault of the tech itself. Not so with, say, Ethereum, the place sketchy sensible contracts are just about a part of the machine.

With Ordinals popularizing the combination of Bitcoin’s blockchain with all method of notorious Ethereum improvements (equivalent to NFTs, tokens and, maybe quickly, sensible contracts), reputational danger to the Bitcoin protocol grows. How lengthy till a token is issued instantly on Bitcoin which passes the Howey Take a look at and so falls afoul of the U.S. Securities and Alternate Fee?

Additional on this regard, Ordinals additionally vastly decrease the barrier to introducing illicit or categorized content material into Bitcoin’s blockchain.

As for the lack of person funds because of rug pulls, bugs, hacks and takedowns, all of those containers have already been ticked below Ordinals. Most just lately, Ordinals Finance pulled a $1 million rug, albeit on the Ethereum facet of the ledger. Simply previous to that, UniSat fumbled the launch of its BRC-20s market, leading to pricey double-spend assaults and a prolonged market halt. Earlier than that, a number of main marketplaces bowed to authorized stress from Yuga Labs and delisted ape-related collections.

Moreover, all of those “hiccups” occurred towards the background of a bug found inside Ordinals’ all-important indexing system. Lastly — and I hate to say this — additional issues of this nature are anticipated. Take into account that one of many largest marketplaces by customers and quantity, Ordinals Pockets in addition to the numerous Ordswap market each hold keys in browser native storage, in line with what I’ve heard on Discord, which runs opposite to really useful safety practices (to say the least).

I imagine the above paragraphs summarize the case towards Ordinals from the attitude of many Bitcoin Maximalists — amongst whose ranks I actually numbered, no less than till the Ordinals purity spiral went helter-skelter. And whereas these issues have advantage, there’s one explicit grievance which I imagine deserves to go unmentioned; that Ordinals are a rip-off.

When keen consumers and keen sellers trade items with informational symmetry, with none claims made as to future value appreciation, nicely, that is the definition of trustworthy enterprise — and that is the present scenario inside Ordinals marketplaces. Show me incorrect.

In Protection Of Ordinals

Some extent in favor of Ordinals is that it is potential to prune their content material from saved blockchain information. Pruning resolves the blockchain file measurement bloat subject, which is pretty trivial contemplating that I anticipate the bloat to be simply outpaced by the expansion of reasonably priced information storage. Extra importantly, pruning ensures that anybody operating a full node can choose out of storing any unlawful materials (which, to be truthful, existed on Bitcoin’s blockchain lengthy earlier than Ordinals).

Regarding the reputational and legislative dangers to Bitcoin arising from Ordinals content material saved on the blockchain, these might be mitigated — however not eradicated — by correct communication. The purpose have to be hammered residence (and never only for the sake of Ordinals) that Bitcoin’s uncensorable and permissionless construction has sure unavoidable drawbacks which, on stability, are vastly outweighed by its benefits.

On the technical entrance, it is potential that post-traumatic stress from the blocksize conflict is main some to view Ordinals as a big-blocker-style assault on Bitcoin’s base layer… however as a wholly non-compulsory Layer 2, Ordinals have much more in frequent with the Lightning Community than with Bcash and its ilk. Granted, content material insertion into witness information can be occurring, however that course of is moderated by charges…

Charges? Lightning? Let’s not bounce forward to the decision of this Ordinals controversy!

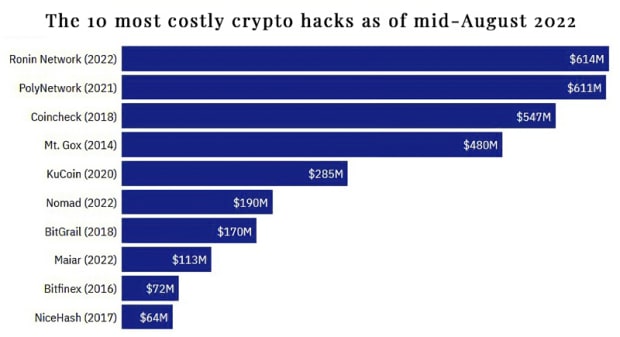

As for the lack of person funds to cyber bandits or technical gremlins, such losses are more likely to stay restricted as a result of comparatively small measurement of the Ordinals financial system. Because the estimated whole worth of all Ordinals assortment on the time of this writing is at present round 1,628 BTC, value some $45 million, nothing approaching the size of the notorious fiascos which have plagued crypto is even potential at this stage:

A lot for taking part in protection. The actual fact is that Ordinals are attracting new customers, builders, artists and corporations to the Bitcoin house. This may certainly have a number of advantages past the quick enhance to the worth and status of the whole ecosystem. Onboarding extra customers of every kind is the surest path to accelerating hyperbitcoinization. And if Bitcoin succeeds, the world might be liberated from the loss of life grip of central banking — however let’s put our ruby-quartz visor again on and refocus.

Whereas most early Bitcoiners acquired on board because of technical curiosity or ideological motivation, later adoption waves had been seemingly pushed by financial elements. Many of those later entrants caught round as a result of they realized Bitcoin is a revolution disguised as a get-rich-quick scheme. Whereas we await the following bull cycle, Ordinals are attracting a contemporary set of customers, composed largely of younger creatives.

Ought to we actually flip these hopefuls away, to wander within the shitcoin swamps?

The Resolution

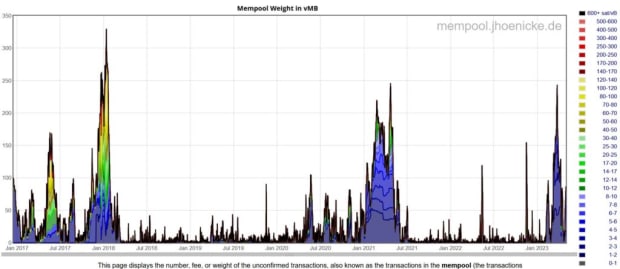

Ordinals have confirmed the robust demand for Bitcoin NFTs, tokens and sensible contracts. Though such issues have been tried on Bitcoin up to now, by means of no matter confluence of things, the time is now demonstrably ripe for them. A fast look at inscription depend over time (at present over 5 million after about 5 months) is sufficient to verify this. The related influence on charges has been equally apparent:

Word that the 2 earlier spikes, across the begins of 2018 and 2021, coincided with the decision of large bull markets. From January of this 12 months, the markets have been pretty calm and the newest spike is attributable to Ordinals. This raises the query of how horrifically excessive charges will get if the present Ordinals quantity persists into the climax of one other bull cycle…

For my part, that is the one essential subject introduced by Ordinals; a looming downside with the potential to outweigh the advantage of the adoption enhance. With charges hitting the 600-plus sat per digital byte (vB) nosebleed ranges final seen in late 2017 and early 2018, Bitcoin may lose as many (or extra) customers to different chains because it good points from Ordinals.

The answer to excessive charges again within the day was the SegWit delicate fork, which vastly lowered the dimensions and costs of conforming transactions. SegWit additionally enabled the launch of the Lightning Community, a layer atop Bitcoin designed to course of low-value transactions. One quirk of Bitcoin is its flat charge and information construction, whereby the price and block house required to ship $1 in BTC is the same as these for sending $1 billion in BTC. Offloading low-value transactions to Lightning frees up block house, leading to decrease bitcoin charges. Together, these two upgrades ensured that when bitcoin pushed to its all-time excessive in 2021, charges remained cheap.

So, why ought to the answer to excessive charges arising from Web3 stuff on Bitcoin be any totally different?

RGB, Taro, Stacks — these are all applied sciences to shunt Web3 transactions and information from the Bitcoin blockchain and onto Layer 2. Whereas the method seen in Ordinals and Stamps of writing content material on to the bottom layer provides unequalled permanence and immutability, it is also extraordinarily pricey. For instance, an artist I spoke with just lately instructed me that he spent $3,800 to inscribe a group. Particularly in these robust financial instances, that is loads for a younger inventive to gamble in an unpredictable market!

Take into account that, as of this writing, 200 of the collections tracked by OrdinalHub have seen zero all-time quantity, as in no gross sales in any respect. This determine barely scratches the floor of market failures. Sorting the 1,000-plus collections on Greatest In Slot by inverse weekly gross sales quantity reveals tons of with zero gross sales. See for your self what number of low-value collections on Ordinals Pockets have had zero quantity or gross sales over the past week. Pending a correct evaluation, my instinct is that fewer than one in 100 inscriptions listed on a market will flip a revenue.

The novelty of Ordinals will fade, however the excessive prices will stay. Provided that Layer 2 options do not retailer information on the blockchain, their creation prices might be orders of magnitude decrease. Excessive-end collections, like Asprey Bugatti Eggs, should still inscribe to Ordinals because the perceived luxurious and maximum-permanence possibility, however the overwhelming majority of creators will go for the cheap alternate options nonetheless linked to Bitcoin, even when not directly.

Price is not the one issue behind the inevitable migration of most customers to Layer 2. The dimensions constraints of Bitcoin blocks make cumbersome content material (like high-resolution pictures or audio, complicated code and all however the shortest video clips) unaffordable and even inconceivable to inscribe. With generative AI making it straightforward to create high-resolution picture content material — and shortly audio and video content material, too — how for much longer will the common creator be content material to pay a relative fortune to inscribe textual content and small, static pictures?

Base Layer To Layer 2

The best way I see issues taking part in out, Ordinals has confirmed the market demand for Bitcoin-based NFTs, tokens, DeFi, and many others. — as unpalatable as some could discover that demand. Regardless, the price and relative slowness of those belongings on the bottom layer ought to ultimately drive most customers to Layer 2 options, already nearing completion. The bottom layer will maybe turn into the digital equal of the Louvre, housing solely essentially the most important works below the tightest safety. Layer 2 will host all the things else.

Ordinal antagonists ought to take be aware. Twitter screeds denouncing inscribers as attackers for including monkey JPEGs to the blockchain solely incite hilarity and encourage defiance. A $100 or perhaps a $25 inscription charge is a much more efficient disincentive, already established and requiring no keyboard bashing. To defuse the looming menace of excessive charges, the proactive technique can be to contribute or donate to the event of Layer 2 options.

This can be a visitor submit by Steven Hay. Opinions expressed are solely their very own and don’t essentially mirror these of BTC Inc or Bitcoin Journal.

from Bitcoin – My Blog https://ift.tt/Z0WSbgL

via IFTTT

No comments:

Post a Comment