Final week, Bitcoin rode the bullish wave it obtained on final fall and broke above the coveted $52,000 degree. Bitcoin regaining virtually all of its losses because the collapse of FTX is a major milestone for the trade that has been struggling to get out of a bear marketplace for the higher a part of the previous yr.

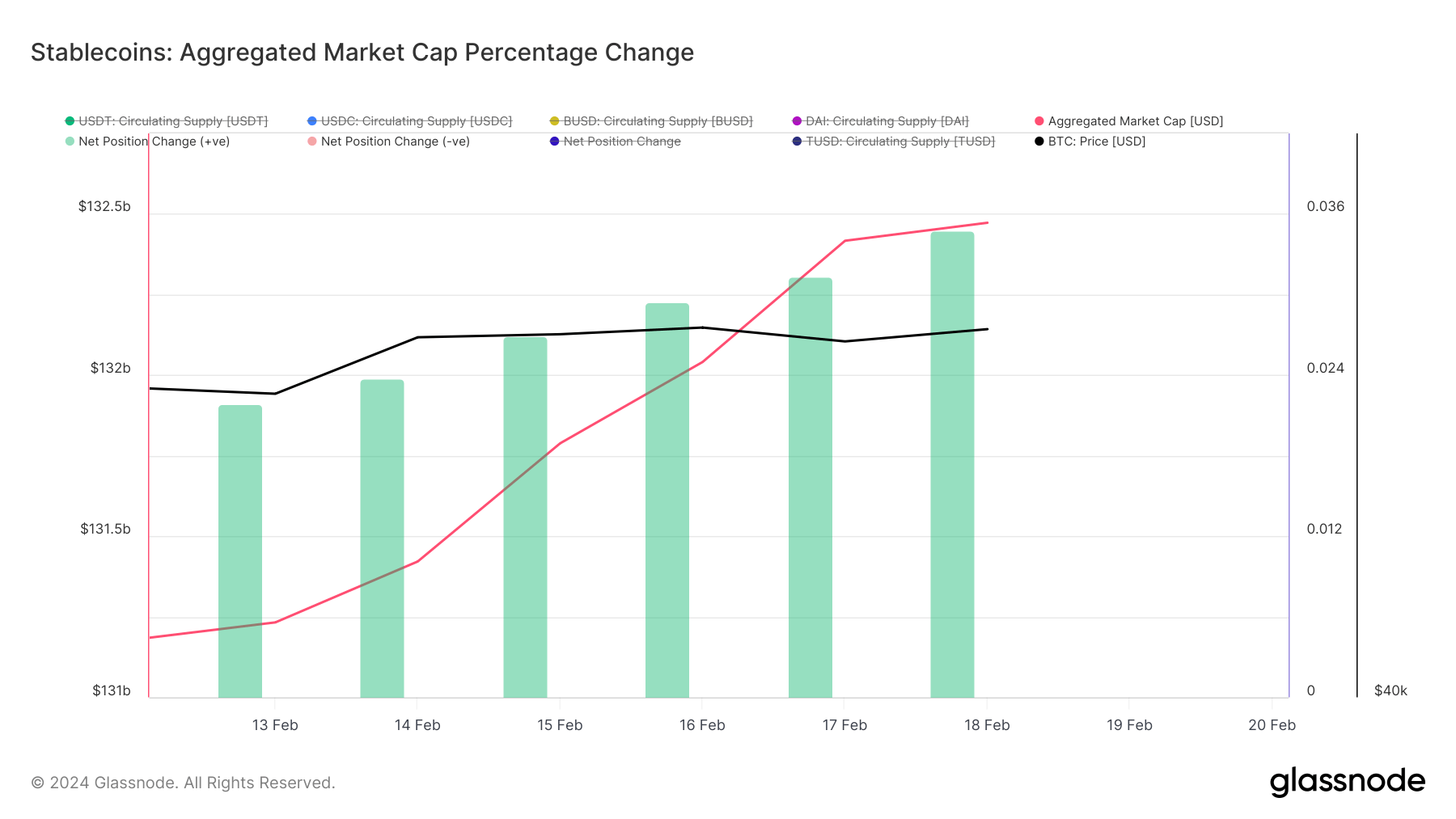

Bitcoin’s upward momentum has been adopted by a rise within the aggregated market cap of main stablecoins, most notably USDT, USDC, BUSD, and DAI. The 4 stablecoin giants noticed their combination market cap develop from $131.232 billion to $132.472 billion between Feb. 13 and Feb. 18, displaying a rising demand.

Stablecoins are a bridge between fiat currencies and the crypto market, making up the vast majority of crypto buying and selling pairs and, due to this fact, the vast majority of market liquidity. The rise in market cap displays a better adoption charge of stablecoins and reaffirms them as a most well-liked medium for interacting with cryptocurrencies.

Zooming out reveals a 3.475% improve within the provide of the highest 4 stablecoins over the previous 30 days. This improve in provide may end up from a number of elements, nevertheless it’s almost definitely a market-wide push to maneuver property (be it fiat or crypto) into stablecoins to arrange for buying and selling. This means that the market is anticipating exercise within the coming weeks and getting ready for faster entry or exit from Bitcoin.

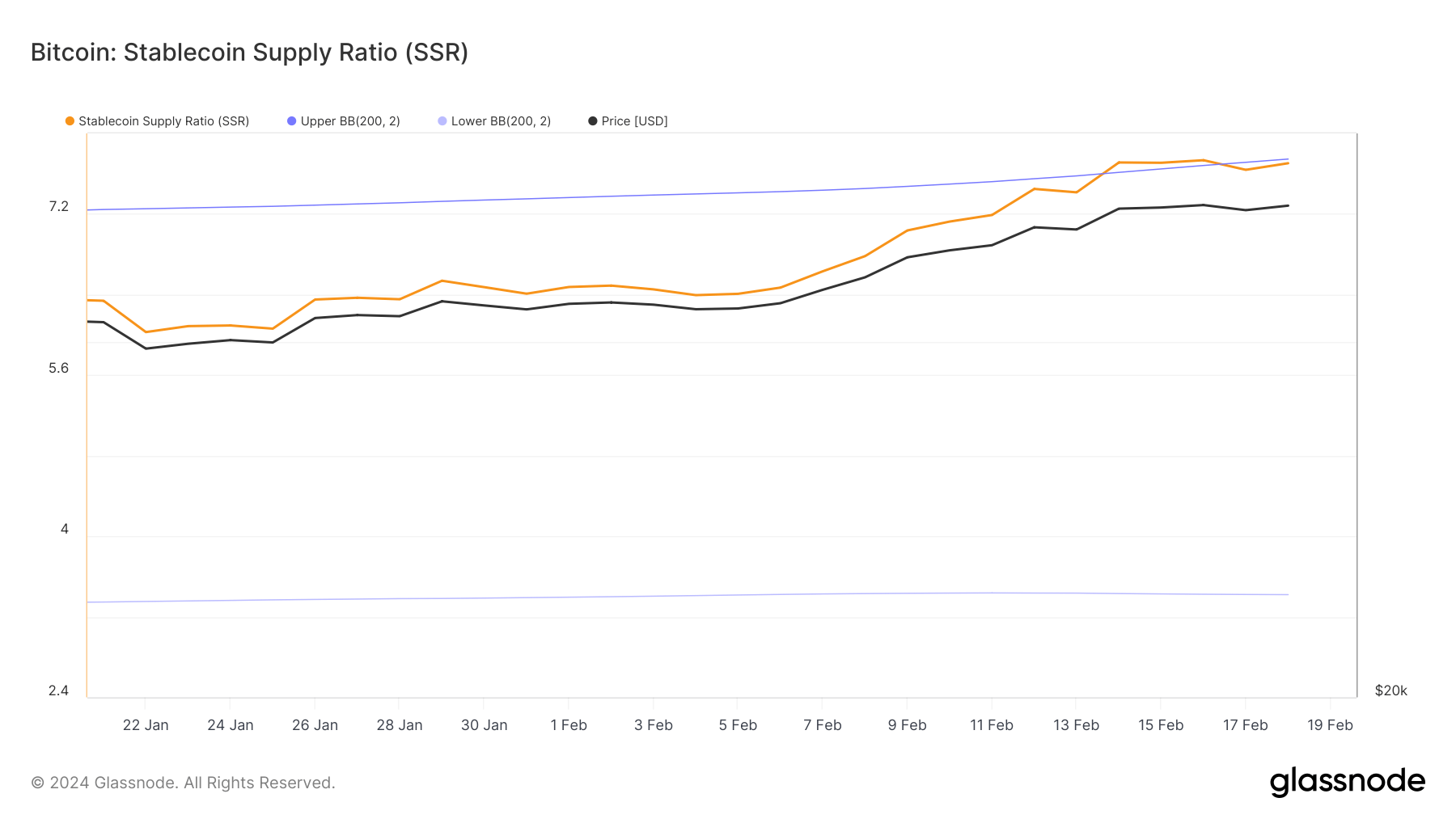

That is additional supported by a notable stablecoin provide ratio (SSR) improve. The SSR is a important metric that measures the provision of stablecoins relative to Bitcoin’s market cap, displaying how deep market liquidity is and the market’s potential shopping for energy. The next SSR signifies that there are extra stablecoins relative to Bitcoin, so the potential shopping for energy may drive Bitcoin’s value up if the stablecoin provide have been to be exchanged into Bitcoin.

The SSR being above the higher Bollinger band from Feb. 14 to Feb. 16 indicators an uncommon improve in potential shopping for energy, presumably indicating that traders have been getting ready to maneuver into Bitcoin or different cryptocurrencies, which is in step with the noticed value improve in Bitcoin throughout this era.

The rise in Bitcoin’s value, alongside a rising market cap and provide of main stablecoins, suggests an inflow of capital into the market. For stablecoins, the noticed tendencies spotlight their important function within the ecosystem, appearing not solely as secure havens throughout occasions of volatility but in addition as important instruments for capital deployment into Bitcoin.

Final week’s tendencies present simply how related the stablecoin market is to Bitcoin and the way actions within the provide and market cap of stablecoins can function indicators of forthcoming market exercise.

from Cryptocurrency – My Blog https://ift.tt/SofO9NC

via IFTTT

No comments:

Post a Comment